Joe Zidle: Inflation Puts Price Discovery on Fast Track

When Byron and I began working on the Ten Surprises of 2022 early this fall, our call for average CPI of 4.5% in 2022 was well above the consensus’ 3.7%. Since then, market watchers have moved toward our camp: according to Bloomberg, the median forecast is now 4.4%. But plenty of forecasters still expect inflation to subside over the next several months and think December’s CPI growth of 7.0% may be one of the highest prints we’ll see this cycle. While they may be proven correct, we continue to expect inflationary pressures to persist.

China lockdowns threaten supply Recently, several major manufacturers in China suspended factory activity due to COVID outbreaks. The important Ningbo-Zhoushan port suspended trucking operations, rerouting ships to Shanghai and worsening congestion at the world’s biggest container port.1 These bottlenecks will likely depress domestic production, with negative repercussions for global supply chains and trade. A continued slowdown in the production and delivery of Chinese exports would further increase goods inflation.

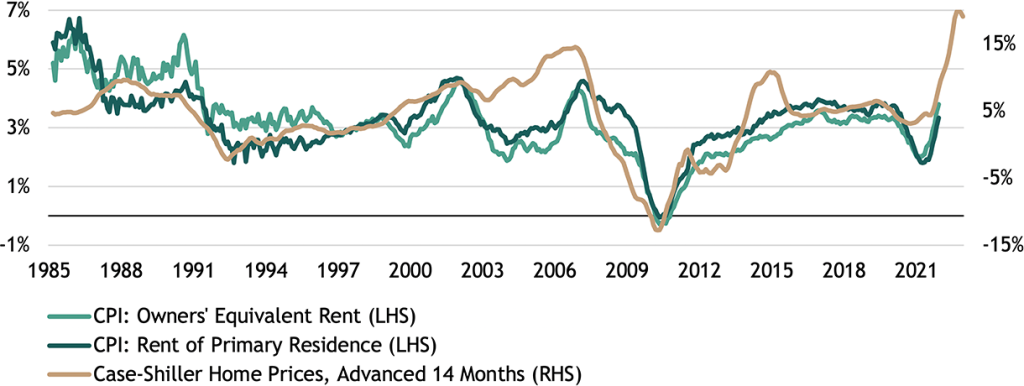

Shelter inflation: movin’ on up In the US, “sticky” components of inflation continue to accelerate, including shelter prices and wages. Shelter prices comprise about one-third of the CPI basket, and after lagging for much of 2021, they rose 4.1% YoY in December—the fastest pace since 2007.ii And it’s not just base effects, as shelter inflation averaged 1.3% QoQ in 4Q21, its highest quarterly growth since 1990.2 Market data suggest that prices have even further to go. Historically, rent CPI is highly correlated with house prices, albeit on a lag, which suggests shelter inflation’s biggest prints are still to come.

Figure 1: CPI Rent Components and Case-Shiller Home Price Index

(YoY%)

Source: Blackstone Investment Strategy and Bureau of Labor Statistics, as of 12/31/2021; S&P 500 Dow Jones Indices, as of 10/31/2021 (data available on a 2-month lag). CPI measures represent the Consumer Price Index for all urban consumers (US city average) and are seasonally adjusted. “Case-Shiller Home Prices” represents the S&P/Case-Shiller US National Home Price Index.

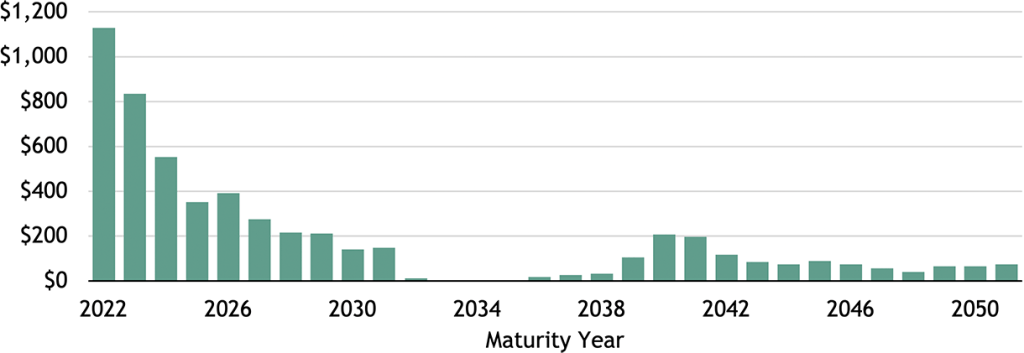

Fed’s balance sheet makeover Our third Surprise of 2022, which penciled in four rate hikes this year, was considered quite aggressive just a few weeks ago. But since the Fed’s hawkish pivot in November, investors are preparing for tighter policy: today, markets are pricing in just under four hikes by year-end.3 Given the strength of the economy and the likelihood of persistent inflation, I’m increasingly convinced that the Fed will go even further and begin quantitative tightening (QT) this year. They could do this by letting maturing securities roll off or by selling longer-dated securities to support the long end of the curve. Either way, a significant proportion of the Fed’s Treasury holdings is set to mature in the next few years, which will shrink its balance sheet.

Figure 2: Maturity Distribution of Federal Reserve’s Treasury Holdings

(US$ in billions)

Source: Blackstone Investment Strategy and the Federal Reserve System Open Market Account (SOMA), as of 1/5/2022. “Treasury Holdings” includes Treasury bills, notes, bonds, Floating Rate Notes (FRNs), and Treasury Inflation-Protected Securities (TIPS).

QT as a catalyst to higher rates The combination of rate hikes and a smaller Fed balance sheet is likely to drive volatility in fixed income and equity markets. It’s also likely to restore price discovery for fixed income products as markets transition from policy support to fundamentals. To be fair, a higher federal funds rate doesn’t always have an immediate effect on the 10-year Treasury yield. There have been periods when the impact was somewhat lagged, like in the early 1980s, and other times when it rolled through quite abruptly, like in the tightening cycle that began in 1994.4 In the near term, I think that the combination of rate hikes and QT could be the catalyst that pushes the 10-year Treasury yield toward 2.75%—one of our Surprises that remains solidly out of consensus.

With data and analysis by Taylor Becker.

- Bloomberg, as of 1/12/2022.

- Blackstone Investment Strategy and the Bureau of Labor Statistics, as of 12/31/2021.

- Bloomberg, as of 1/13/2022. Based on rates implied by 2022 monthly fed funds futures contracts.

- Based on Federal Reserve Board calculations of the 10-year Treasury yield (constant maturity) and the effective federal funds rate.

The views expressed in this commentary are the personal views of Joe Zidle and do not necessarily reflect the views of Blackstone Inc. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of Joe Zidle as of the date hereof, and neither Joe Zidle nor Blackstone undertake any responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Blackstone and others associated with it may also offer strategies to third parties for compensation within those asset classes mentioned or described in this commentary. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.

For more information about how Blackstone collects, uses, stores and processes your personal information, please see our Privacy Policy here: www.blackstone.com/privacy.