1. Medicines brought to market by BXLS and development company employees and advisors (Nick Galakatos, Paris Panayiotopoulos, Kurt Wheeler, Barry Gertz, Dennis Henner, Deborah Dunsire, Kiran Reddy, Francois Nader, Olivier Brandicourt, John Maraganore, Peter Honig, Mikael Dolsten and Allison Jeynes-Ellis) while they worked at BXLS, Clarus and at prior employers. The development of a medicine involves many professionals. The degree of involvement by a given BXLS, advisor, or development company professional varies medicine to medicine. Therefore, the performance shown reflects the contributions of a number of professionals and may not be indicative of any individual’s contributions to the transactions. The number of developed medicines is measured when a drug is approved in any jurisdiction.

2. Therapeutic Platform Teams and Development Company employees, BXLS Executive, Senior and Operating Advisors are not Blackstone employees. Certain professionals are not dedicated to BXLS and will perform work for other Blackstone business units. There can be no assurance that such professionals will continue to be associated with BXLS throughout the life of an investment. The level of involvement and role of the professionals with BXLS may vary, including having no involvement or role at all. These individuals’ medical licenses may not be currently active.

3. As of March 31, 2025. Based on Phase III drug developments analyzed between 2010 to 2025. In deriving the Phase III success rate, Blackstone uses the same methodology as Evaluate Pharma, neither of which methodology incorporates data relating to approval for MedTech products. In determining the success rate, both Blackstone and Evaluate Pharma consider a drug’s approval by the US FDA or the EMA to each count as a separate, independent approval and a drug’s approval in each new indication to also be considered an approval when calculating the success rate. This methodology may result in a higher success rate than would otherwise result if only one of the aforementioned types of approval were used when calculating the success rate. For purposes of calculating the success rate, Blackstone does not include any Phase III trials that were never initiated. A trial is considered “initiated” when the first patient is enrolled in a clinical trial. For the avoidance of doubt, Blackstone considers suspended, abandoned, or never completed trials as “failures” when determining the success rate. Whereas Evaluate Pharma’s review period is as of January 1, 2000 – March 31, 2025, BXLS’ review period is from 2010 to 2025, which coincides with the period beginning when BXLS, through a predecessor fund, made its first investment in a Phase III drug trial. Evaluate Pharma’s data represents their most recently available data. There are risks and limitations to comparing BXLS’ shortened period of review to Evaluate Pharma’s longer and different period because market conditions, including among others macroeconomic factors and regulatory and policy considerations, as well as other factors beyond BXLS’ control, change regularly and could adversely impact the likelihood of approval, thereby negatively impacting the industry’s and BXLS’ success rates in a given time period. These and numerous other factors may adversely affect the success rates, and thus success rates in one time period are not directly comparable to success rates of drugs evaluated in different time periods.

4. The annual funding gap is BXLS’s estimate of the gap between the annual spread between the demand for medicine and device development capital and the supply of development capital from pharmaceutical and MedTech companies through R&D budgets. Data sources are Evaluate Pharma and Morgan Stanley, Market Update Presentation to BXLS. January 2024.

5. In BXLS, a small percentage of our deals could include equity investments in our counterparties. Note that other BXLS investments may additionally include equity kicker investments that are ancillary to the primary investment.

6. There is no assurance that any Blackstone Life Sciences or any other Blackstone strategy will effectively hedge inflation.

Blackstone Life Sciences (BXLS)

Our goal is to bring vital medicines and technologies to market by designing, funding and executing clinical trials for products generally in late-stage development.

Note: All figures as of March 31, 2025, unless otherwise indicated.

WHAT WE DO

We collaborate with pharmaceutical, biotech and medical technology companies to aim to address unmet medical needs that have the potential to improve the quality of life for patients around the world.

Filling a Void

We believe Blackstone Life Sciences (BXLS) fills a void in the industry. While the life sciences are experiencing unprecedented innovation driven by rapid advancements in science and technology, there is not sufficient funding to convert innovation into products[4]. BXLS aims to fill that void by collaborating with leading pharmaceutical, biotechnology and medical technology companies to jointly advance their critical path products to patients.

Expertise and Scale

BXLS combines its clinical, commercial and operational expertise with Blackstone’s global network, access to capital, and infrastructure. We commit our skill and scale to select, fund and advance what we believe to be the most promising life science products and companies through hands-on involvement and directly applied expertise.

Seeking Primarily Attractive Market Uncorrelated Returns[5] at Lower Risk

We seek to deliver attractive value at lower risk through strategies like funding the late-stage development of innovative core products from highly credible counterparties . We aim to generate returns that are mostly market and interest rate uncorrelated[6] by capturing value directly from the products we fund, rather than from exposure to equity.

CASE STUDIES

The Blackstone Life Sciences investment and operations team is responsible—both in its current capacity and prior experiences—for bringing 200+ medicines to market in 13 different therapeutic areas.[1]

MODERNA COLLABORATION

ALNYLAM

ANTHOS THERAPEUTICS, INC

MODERNA COLLABORATION

-

Moderna Collaboration

Moderna Collaboration

In March 2024, Blackstone Life Sciences announced a new collaboration to advance Moderna’s influenza mRNA vaccine program, for which BXLS will provide up to $750M of funding. This landmark transaction showcases our long-standing strategy to collaborate with the world’s leading life science companies to advance their critical path products.

-

Alnylam

Alnylam

In April 2020, BXLS led a $2 billion strategic collaboration with Alnylam anchored around the acquisition of a royalty interest in inclisiran (Leqvio®), an innovative product, which will potentially bring new benefits to patients with high cholesterol — a major risk factor for cardiovascular disease. The drug has now received over 90 regulatory approvals and is marketed globally.

-

Anthos Therapeutics, Inc.

Anthos Therapeutics, Inc.

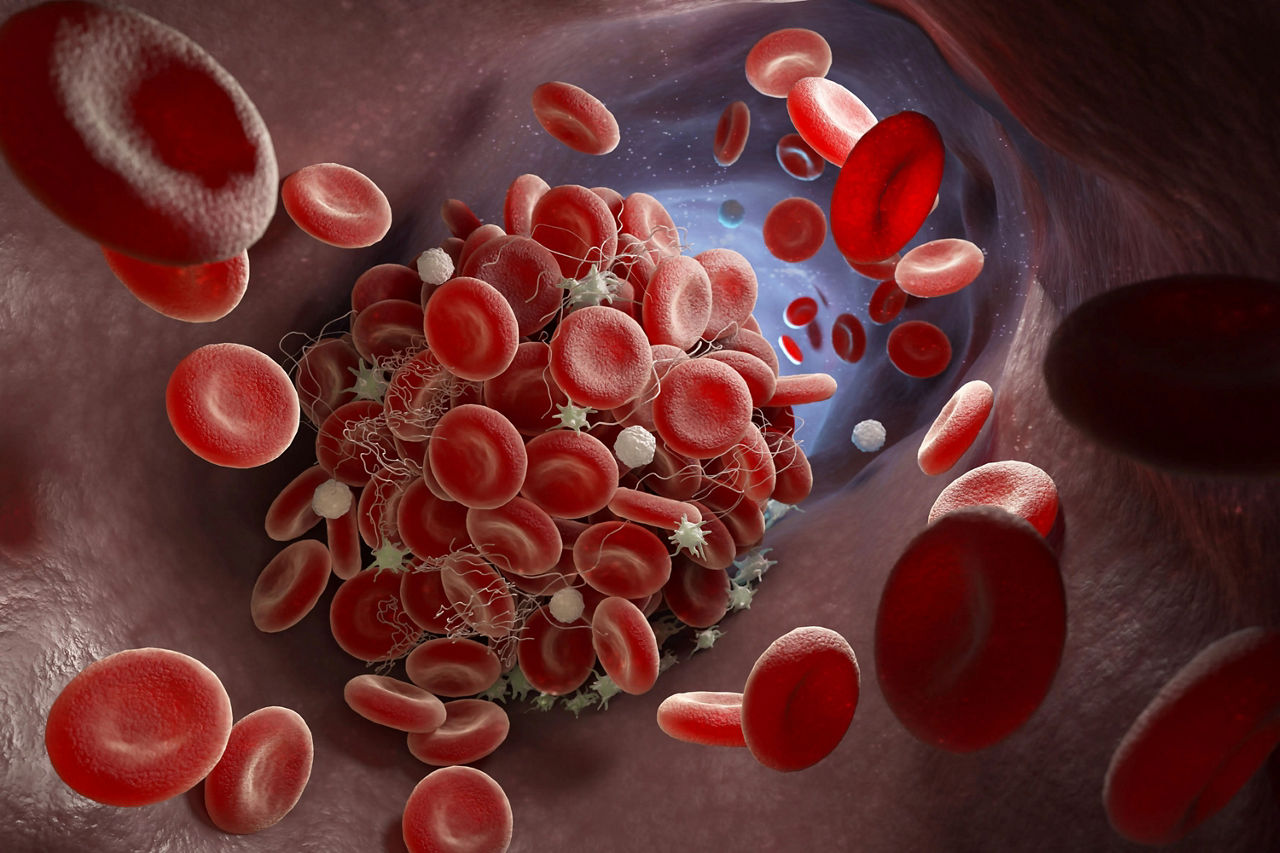

In February 2019, BXLS founded Anthos Therapeutics, Inc. in collaboration with Novartis seeking to advance next-generation targeted therapies for high-risk cardiovascular patients. This investment is funding potential next-generation antithrombotic therapies for patients that are underserved by more conventional medicines. According to the American Heart Association, thrombotic disorders cause nearly 500,000 deaths each year.

Anthos was sold to Novartis in April 2025. This transaction is a representative example of a BXLS ownership investment, where we form and grow a company around a promising clinical asset that addresses a large unmet medical need.

NEWS & INSIGHTS

Q&A: Nick Galakatos on

“A Differentiated Approach to Life Sciences Investing”

We recently spoke with Dr. Nick Galakatos, Global Head of Blackstone Life Sciences, to learn about his differentiated approach to life sciences investing, strategy for mitigating risk and outlook for the sector.

WSJ: New Blood Thinners Will Prevent Blood Clots Without Causing Bleeding

Several blood thinners are being developed that could prevent the clots that cause heart attacks and strokes – without some of the side effects.

PE Hub: Blackstone Life Sciences’ Nicholas Galakatos Hails ‘New Era in Medicine’

Nick Galakatos, Global Head of Blackstone Life Sciences, discusses the recent wave of potential medicines thanks to innovation and breakthroughs in technology – and how partners like BXLS can help accelerate treatment development pipelines that would otherwise be limited by the availability of capital.