Despite strains on the U.S. banking system in the first quarter of 2023, the Federal Reserve has indicated that it remains committed to shrinking its balance sheet—unwinding years of quantitative easing that grew its holdings from $1 trillion in 2008 to nearly $9 trillion in 2022.

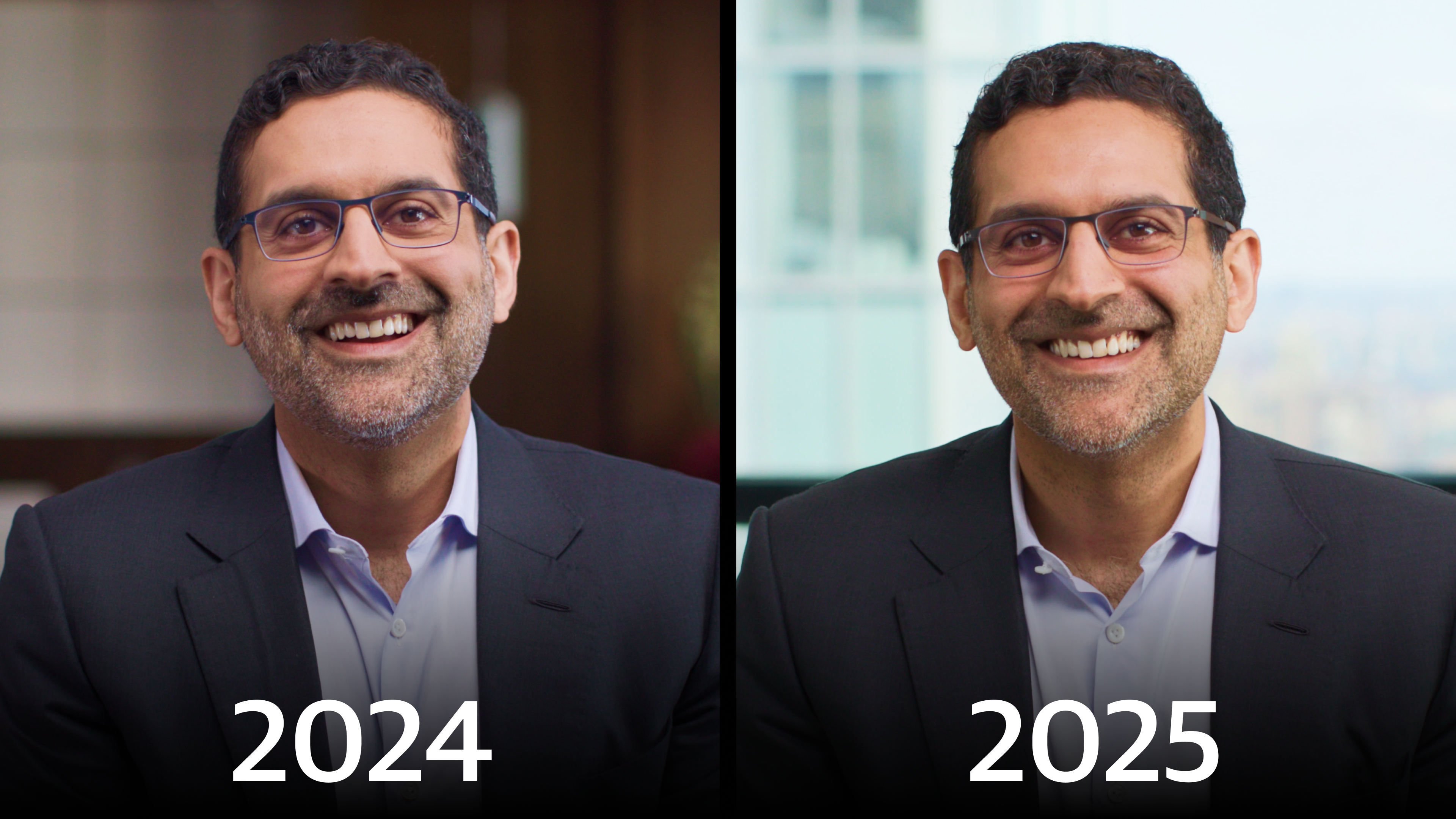

Joe Dowling, Global head of BAAM—Blackstone’s multi-asset investing platform—discusses what this era of quantitative tightening means for asset allocators. Dowling, who previously oversaw Brown University’s endowment, advocates for active management and sees opportunity across the private markets, from private equity and real estate to credit and secondaries. He also highlights how absolute return can help investors mitigate risk in volatile markets. Watch the full video to learn more.

The 40% Problem

June 24, 2025