Insights

Investment Strategy

The 40% Problem

Market Views

Q&A: Greg Blank on Infrastructure Investing’s Trillion Dollar Opportunities

Market Views

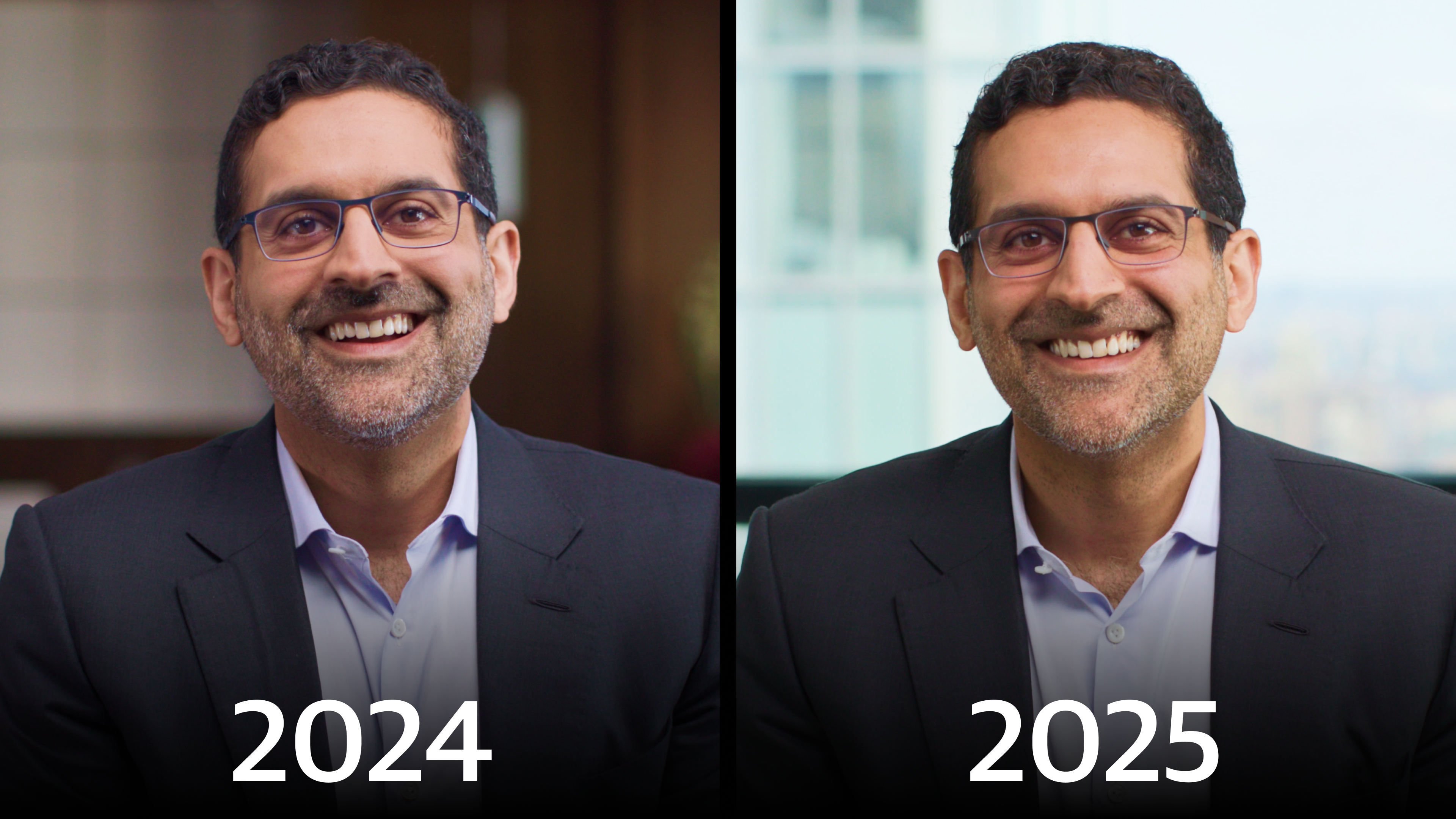

Nadeem Meghji: One Year on the Job

Investment Strategy

Cutting Through the Noise: The Long-Term Case for Data Centers | The Connection

Investment Strategy

Disasters Have a Way of Not Happening | The Connection

Investment Strategy

The Connection – Spring 2025

Market Views

Q&A: Nick Galakatos on “A Differentiated Approach to Life Sciences Investing”

Market Views

One-on-One with Amit Dixit: All Eyes on India

Investment Strategy

A Broader Toolkit to Capitalize on the Credit Opportunity | The Connection

Investment Strategy

“Work the Problem” | The Connection

Market Views

Market Views: A Note of Optimism for 2025

Portfolio Insights