Three months average price prior to and including 14RECOMMENDED CASH OFFER outside the United States by UBS INVESTMENT BANK and DEUTSCHE BANK for and on behalf of TBG CARECO LIMITED a company formed at the request of funds advised by BLACKSTONE and in the United States by TBG CARECO LIMITED for all the issued and to be issued share capital of NHP PLC

Summary

Commenting on the Offer, Sir John Martin Kirby Laing CBE, Chairman of NHP, said:

“The recovery in NHP’s business brought about by the current senior management team has led to a 14 fold increase in the share price within the last 4 years and an 83.4 per cent. increase in the share price over the last 12 months. The Offer from TBG CareCo gives shareholders the opportunity to realise the value of their investment in cash at an attractive price. The combination of Southern Cross (Blackstone’s existing operating business) and Highfield Care will offer new opportunities for our staff and further enhance the service we provide to our residents.”

Commenting on the Offer, Joseph Baratta, a principal of The Blackstone Group International Limited, said:

“We believe NHP is a unique asset in the UK care home sector; it owns the largest portfolio of care home properties in the industry and, through Highfield Care, is one of the leading operators. Combining Highfield Care with Southern Cross, a company we acquired in September of this year, creates the operator with the largest number of care homes in the UK. We intend to capitalize on the scale and breadth of the enlarged Southern Cross / Highfield Care business to continue to improve the quality of care to our residents and to offer increasingly more services to local authorities and the NHS.”

This summary should be read in conjunction with the full text of the attached announcement. The full terms and conditions of the Offer will be set out in the Offer Document and the accompanying Form of Acceptance. In deciding whether or not to accept the Offer, NHP Shareholders must rely solely on the terms and conditions of the Offer and the information contained, and the procedures described, in the Offer Document and the accompanying Form of Acceptance. The Offer Document and Form of Acceptance will be posted to NHP Shareholders as soon as practicable and, in any event, within 28 days of this announcement.

This announcement does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any security, nor is it a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of the securities referred to in this announcement in any jurisdiction in contravention of applicable law.

UBS is acting exclusively for Blackstone and TBG CareCo in connection with the Offer and noone else and will not be responsible to anyone other than Blackstone and TBG CareCo for providing the protections afforded to clients of UBS nor for providing advice in relation to the Offer or in relation to the content of this announcement or any other transaction or arrangement referred to herein.

Deutsche Bank, which is regulated by the Financial Services Authority for the conduct of designated investment business in the UK, is acting exclusively for Blackstone and TBG CareCo and no-one else in connection with the Offer, and will not be responsible to anyone other than Blackstone and TBG CareCo for providing the protections afforded to clients of Deutsche Bank nor for providing advice in relation to the Offer or in relation to the content of this announcement or any other transaction or arrangement referred to herein.

Rothschild, which is authorised and regulated by the Financial Services Authority in the United Kingdom, is acting for NHP and no one else in relation to the Offer and will not be responsible to anyone other than NHP for providing the protections afforded to clients of Rothschild or for providing advice in relation to the Offer or in relation to the contents of this announcement or any transaction or arrangement referred to herein.

Collins Stewart, which is authorised and regulated by the Financial Services Authority, is acting for NHP and no one else in relation to the Offer. Collins Stewart is not acting for, and will not be responsible to anyone other than NHP for providing the protections afforded to customers of Collins Stewart or for providing advice in relation to the Offer or in relation to the contents of this announcement or any transaction or arrangement referred to herein.

The release, publication or distribution of this announcement in certain jurisdictions may be restricted by law and therefore persons in any such jurisdictions into which this announcement is released, published or distributed should inform themselves about and observe such restrictions.

Copies of this announcement and any formal documentation relating to the Offer are not being, and must not be, directly or indirectly, mailed or otherwise forwarded, distributed or sent in or into or from Australia, Canada or Japan and will not be capable of acceptance by any such use, instrumentality or facility within Australia, Canada or Japan and persons seeking such documents (including custodians, nominees and trustees) must not mail or otherwise forward, distribute or send them in or into or from Australia, Canada or Japan. The Offer (unless otherwise determined by TBG CareCo and permitted by applicable law and regulation), will not be made, directly or indirectly, in or into, or by the use of mails or any means of instrumentality (including, without limitation, telephonically or electronically) of interstate or foreign commerce of, or any facility of a national, state or other securities exchange of Australia, Canada or Japan and the Offer will not be capable of acceptance by any such use, means, instrumentality or facilities.

The ability of NHP Shareholders who are not resident in the United Kingdom or the United States to accept the Offer may be affected by the laws of the relevant jurisdictions in which they are located. Persons who are not resident in the United Kingdom or the United States should inform themselves of, and observe, any applicable requirements.

This document, including information included or incorporated by reference in this document, contains “forward-looking statements” concerning TBG CareCo and NHP. Generally, the words “will”, “may”, “should”, “continue”, “believes”, “expects”, “intends”, “anticipates” or similar expressions identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond the companies’ ability to control or estimate precisely, such as future market conditions and the behaviour of other market participants. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to have been correct. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this document.

TBG CareCo or companies in association with TBG CareCo may purchase NHP Shares otherwise than under the Offer, such as in open market or privately negotiated purchases. Such purchases may be made either directly or through a broker and such purchases shall comply with the applicable laws of the UK as well as the rules of the London Stock Exchange and the City Code. TBG CareCo shall disclose in the UK and the United States by means of a press release such purchases of NHP Shares outside the Offer as required by applicable UK law, as well as the rules of the London Stock Exchange and the City Code.

The Offer in the United States is being made solely by TBG CareCo pursuant to an exemption from the US tender offer rules provided by Rule 14d-1(c) under the US Securities Exchange Act of 1934 (as amended). Neither UBS, Deutsche Bank, nor any of their respective affiliates, is making the Offer in the United States.

RECOMMENDED CASH OFFER

outside the United States by UBS INVESTMENT BANK and DEUTSCHE BANK for and on behalf of TBG CARECO LIMITED a company formed at the request of funds advised by BLACKSTONE and in the United States by TBG CARECO LIMITED

for all the issued and to be issued share capital of NHP PLC

1. Introduction

The boards of TBG CareCo and NHP are pleased to announce that they have reached agreement on the terms of a recommended cash offer for the entire issued and to be issued share capital of NHP to be made outside the United States by UBS and Deutsche Bank for and on behalf of TBG CareCo and in the United States by TBG CareCo. TBG CareCo is a new company established at the request of the Blackstone Funds specifically for the purpose of making the Offer. The Blackstone Funds are advised by Blackstone. The Blackstone Funds and Blackstone are affiliates of The Blackstone Group.

The NHP Directors, who have been so advised by Rothschild, consider the terms of the Offer to be fair and reasonable. In providing their advice, Rothschild has taken into account the commercial assessments of the NHP Directors. The NHP Directors intend unanimously to recommend that NHP Shareholders accept the Offer.

2. The Offer

Under the Offer, which will be subject to the Conditions and to the full terms and conditions to be set out in the Offer Document and the accompanying Form of Acceptance, NHP Shareholders will receive: for each NHP Share

The Offer values the entire issued and to be issued share capital of NHP at approximately £563.5 million and represents a premium of approximately 12.1 per cent. to the Closing Price of 232 pence per NHP Share on 14 September 2004, being the last trading day prior to commencement of the offer period.

The bases and sources of certain financial information contained in this announcement are set out in Appendix II.

3. Background to and reasons for recommending the Offer

The current senior management of NHP, appointed during 2000, implemented a strategy to recover and optimise value for shareholders. Key steps taken include:

During this period, the Closing Price per NHP Share has risen from an all-time low of 18.17 pence on 22 December 2000 to 257 pence on 26 November 2004, representing approximately a 14 fold increase in less than four years.

During the preparation for the disposal of Highfield Care, the NHP Directors received a number of preliminary approaches for NHP. Movement in the share price and press speculation necessitated an announcement regarding these discussions on 15 September 2004.

The result of this process is the Offer at 260 pence in cash per NHP Share, which represents a premium of approximately:

The Offer is at a higher level than any of the approaches previously received and in arriving at their decision to recommend the Offer, the NHP Directors have considered, inter alia, the following:

In light of the factors set out above, the NHP Directors believe that it is in the best interests of NHP Shareholders to be afforded the opportunity of realising their investment for cash at the best available price at this time. In this context, the Offer is considered by the NHP Directors to represent fair value when compared to the net asset position and the likely proceeds from the sale of Highfield Care.

4. Recommendation

The NHP Directors, who have been so advised by Rothschild, consider the terms of the Offer to be fair and reasonable. In providing their advice, Rothschild has taken into account the commercial assessments of the NHP Directors.

The NHP Directors intend unanimously to recommend NHP Shareholders to accept the Offer, and they have irrevocably undertaken to accept the Offer in respect of their entire beneficial holdings of NHP Shares amounting, in aggregate, to approximately 0.05 per cent. of the issued NHP Shares.

5. Adjusted net assets

Set out in Appendix III is a calculation of the unaudited adjusted net assets as at 30 September 2003 (being the audited net asset value as at 30 September 2003, which was published by NHP in its Annual Report and Accounts, adjusted for the items described in Appendix III).

An updated statement of net assets as at 30 September 2004 will be contained in the Offer Document. An independent valuation of the Group’s properties will also be contained in the Offer Document. It is the expectation of the NHP Directors that the net asset value of NHP as at 30 September 2004 will be substantially higher than the net asset value of NHP as at 30 September 2003.

6. Irrevocable undertakings

In total, TBG CareCo has received irrevocable undertakings and statements of intent to accept the Offer in respect of a total of 63,396,629 NHP Shares, representing approximately 30.5 per cent. of the issued NHP Shares. Of this total, TBG CareCo has received irrevocable undertakings to accept the Offer in respect of a total of 107,660 NHP Shares, representing approximately 0.05 per cent. of the issued NHP Shares, from NHP Directors who are also NHP Shareholders. These undertakings from the NHP Directors will remain binding and will require acceptance of the Offer notwithstanding any higher competing offer, but will lapse if the Offer lapses or is withdrawn without becoming or being declared unconditional in all respects.

TBG CareCo has also received irrevocable undertakings to accept the Offer in respect of a total of 10,415,100 NHP Shares, representing approximately 5.0 per cent. of the issued NHP Shares, from certain institutional NHP Shareholders. These NHP Shareholders’ undertakings will lapse (i) in the case of an undertaking relating to 4,602,600 NHP Shares, representing approximately 2.2 per cent. of the issued NHP Shares, if a competing offer which is higher in value than the Offer is made by a third party within 14 days of the date of this announcement, and (ii) in the case of an undertaking relating to 5,812,500 NHP Shares, representing approximately 2.8 per cent. of the issued NHP Shares, if a competing offer which exceeds 110 per cent. of the value of the Offer is made by a third party within 14 days of the date of this announcement and is not subsequently matched by TBG CareCo within 21 days of such competing offer. In both cases, the NHP Shareholders’ undertakings will lapse if the Offer lapses or is withdrawn without becoming or being declared unconditional in all respects.

Finally, TBG CareCo has received non-binding statements of intent to accept the Offer in respect of a total of 52,873,869 NHP Shares, representing approximately 25.5 per cent. of the issued NHP Shares, from certain institutional NHP Shareholders.

7. Reasons for the Offer

Southern Cross BidCo Limited, a company indirectly controlled by the BCP IV Funds, acquired Southern Cross Healthcare Holdings Limited in September of this year as the first step in a contemplated consolidation strategy in the UK care home sector. Blackstone believes NHP is the ideal complement to Southern Cross due to the fact that Southern Cross is NHP’s largest third party tenant and that the combination of Highfield Care with Southern Cross creates the operator with the largest number of care homes in the UK.

Following the Offer becoming or being declared wholly unconditional, it is intended that the NHP and Southern Cross businesses will be reorganised so as to consolidate their respective operating businesses on one hand and property businesses on the other.

8. Information on TBG CareCo and The Blackstone Group

TBG CareCo

TBG CareCo is a private company registered in England and Wales and was incorporated on 25 November 2004. TBG CareCo is a wholly owned subsidiary of TBG CareCo UK, which is itself a wholly owned subsidiary of TBG CareCo Investments 2. TBG CareCo Investments 2 is a wholly owned subsidiary of TBG CareCo Investments 1, which is a wholly owned subsidiary of TBG CareCo Holdings.

Each of TBG CareCo, TBG CareCo UK, TBG CareCo Investments 2, TBG CareCo Investments 1 and TBG CareCo Holdings is a new company formed at the request of the Blackstone Funds for the purpose of making the Offer and has not, since its incorporation, traded or entered into any obligations other than in connection with the Offer.

The Blackstone Group

The Blackstone Group was founded in 1985 by Peter Peterson and Stephen Schwarzman; the firm has offices in New York, London, Paris and Hamburg. The Blackstone Group’s Private Equity Group has raised over US$14 billion and its Real Estate Group has raised over US$6 billion in total equity across five funds. In addition to private equity and real estate, The Blackstone Group’s core businesses include corporate debt investing, marketable alternative asset management, mergers and acquisitions advisory and restructuring and reorganisation advisory.

9. Information on NHP

NHP currently owns over 355 care homes, with more than 17,400 beds, throughout the UK, making it one of the country’s largest owners of private care beds. The Group’s ordinary shares have been listed on the London Stock Exchange since 1995. The majority of its investment in its homes portfolio has been funded by three securitised bond issues. The total debt raised from securitisations over the period from 1995 to 1999 was £559 million at an average fixed interest rate of 6.7 per cent.

The property division of the Group acts as a landlord for nine third-party care home operators, which collectively operate 192 properties with some 9,500 beds. Highfield Care is the operating business of the Group established in 2001 through the acquisition of a number of homes. Currently, it is the fourth largest care home operator in the UK managing 165 NHP-owned homes (with some 7,850 beds) and a further 20 third-party homes (with more than 1,000 beds).

For the year ended 30 September 2003, NHP reported turnover of £171.9 million and a profit before tax of £24.8 million. As at 30 September 2003, NHP had net assets of £320.5 million and net assets per NHP Share of 157.6 pence.

The Offer Document will include the consolidated audited preliminary results of NHP for the financial year ended 30 September 2004.

10. Management and employees

TBG CareCo has given assurances to the NHP Board that, if the Offer becomes or is declared unconditional in all respects, the existing employment rights, including existing pension rights, of all NHP employees will be fully safeguarded. The non-executive directors of NHP intend to resign from the NHP Board when the Offer becomes or is declared wholly unconditional.

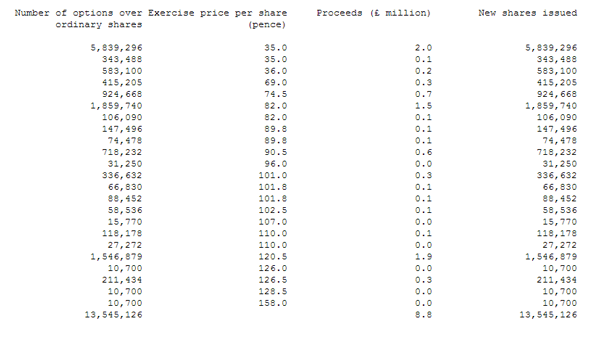

11. NHP Share Option Schemes

The Offer will affect share options granted under the NHP Share Option Schemes. Participants in the NHP Share Option Schemes will be contacted regarding the effect of the Offer on their rights and appropriate proposals will be made in due course.

12. Financing of the Offer

The cash consideration payable by TBG CareCo to NHP Shareholders under the terms of the Offer will be provided to TBG CareCo by the Blackstone Funds and third party debt facilities arranged by Barclays Capital, the investment banking division of Barclays Bank plc, and Citigroup Global Markets Limited.

13. Inducement fee agreement

NHP and TBG CareCo have entered into an agreement under which NHP has agreed to pay a break fee to TBG CareCo (or its designee) of 1 per cent. of the fully diluted value of the Offer (approximately £5.6 million) in the event that: (i) a competing proposal is announced prior to the Offer lapsing or being withdrawn and such competing proposal subsequently becomes or is declared wholly unconditional or is completed; or (ii) the NHP Directors fail to recommend the Offer in the Offer Document; or (iii) the NHP Directors withdraw or adversely modify their recommendation of the Offer.

NHP has also undertaken not to actively seek any competing offers.

14. Compulsory acquisition, de-listing and re-registration

After the Offer becomes or is declared unconditional in all respects, TBG CareCo intends to procure the making of an application by NHP to the appropriate authorities for the cancellation of (i) the listing of NHP Shares on the Official List, and (ii) the admission to trading of NHP Shares on the London Stock Exchange’s market for listed securities. It is anticipated that cancellation of listing and trading will take effect no earlier than 20 Business Days after the Offer becomes or is declared unconditional in all respects. De-listing would significantly reduce the liquidity and marketability of any NHP Shares not assented to the Offer.

If TBG CareCo receives acceptances of the Offer in respect of, and/or otherwise acquires, 90 per cent. or more of the NHP Shares to which the Offer relates, TBG CareCo intends to exercise its rights pursuant to the provisions of sections 428 to 430F of the Companies Act to acquire the remaining NHP Shares to which the Offer relates.

Following the Offer becoming or being declared unconditional in all respects and after the NHP Shares are de-listed, TBG CareCo intends to re-register NHP as a private company under the relevant provisions of the Companies Act.

15. Overseas shareholders

The availability of the Offer to persons who are not resident in the United Kingdom or the United States may be affected by the laws of their relevant jurisdiction. Such persons should inform themselves of, and observe, any applicable legal or regulatory requirements of their jurisdiction. Further details in relation to overseas shareholders will be contained in the Offer Document.

16. General

The Offer Document will be posted to NHP Shareholders and, for information only, to participants in the NHP Share Option Schemes (in each case other than to persons with addresses in Restricted Jurisdictions), as soon as practicable and in any event within twentyeight days of the date of this announcement unless agreed otherwise with the Panel.

Save for the 2,750,000 NHP Shares held by Artemis UK Special Situations Fund, the 3,062,500 NHP Shares held by Artemis UK Smaller Companies Fund, the 300,000 NHP Shares held by Old Mutual Dublin UK Smaller Co’s Fund, the 55,600 NHP Shares held by Bright Capital UK Specialist Equity Fund, the 475,000 NHP Shares held by Old Mutual UK Specialist Equity Fund, the 1,580,000 NHP Shares held by Old Mutual UK Select Mid Cap Fund, the 635,000 NHP Shares held by Old Mutual UK Smaller Companies Fund, the 142,000 NHP Shares held by Old Mutual UK Select Equity Fund, the 1,415,000 NHP Shares held by Old Mutual UK Select Smaller Companies Fund and the 107,660 NHP Shares held by NHP Directors who are also NHP Shareholders, in respect of which TBG CareCo has received irrevocable undertakings, neither TBG CareCo nor, so far as TBG CareCo is aware, any person acting in concert with TBG CareCo, or in respect of which irrevocable undertakings have been provided to TBG CareCo, owns or controls any NHP Shares or any securities convertible or exchangeable into NHP Shares or any rights to subscribe for or purchase the same, or holds any options (including traded options) in respect of, or has any option to acquire, any NHP Shares or has entered into any derivatives referenced to NHP Shares (“Relevant NHP Securities”) which remain outstanding, nor does any such person have any arrangement in relation to Relevant NHP Securities. For these purposes, “arrangement” includes any indemnity or option arrangement, any agreement or understanding, formal or informal, of whatever nature, relating to Relevant NHP Securities which may be an inducement to deal or refrain from dealing in such securities. In the interests of secrecy prior to this announcement, TBG CareCo has not made any enquiries in this respect of certain parties who may be deemed by the Panel to be acting in concert with it for the purposes of the Offer. Enquiries of such parties will be made as soon as practicable following the date of this announcement and any material disclosure in respect of such parties will be included in the Offer Document.

The full terms and conditions of the Offer will be set out in the Offer Document and the accompanying Form of Acceptance. In deciding whether or not to accept the Offer, NHP Shareholders must rely solely on the terms and conditions of the Offer and the information contained, and the procedures described, in the Offer Document and the accompanying Form of Acceptance. The Offer Document and Form of Acceptance will be posted to NHP Shareholders as soon as practicable and, in any event, within 28 days of this announcement.

This announcement does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any security, nor is it a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of the securities referred to in this announcement in any jurisdiction in contravention of applicable law.

UBS is acting exclusively for Blackstone and TBG CareCo in connection with the Offer and noone else and will not be responsible to anyone other than Blackstone and TBG CareCo for providing the protections afforded to clients of UBS nor for providing advice in relation to the Offer or in relation to the content of this announcement or any other transaction or arrangement referred to herein.

Deutsche Bank, which is regulated by the Financial Services Authority for the conduct of designated investment business in the UK, is acting exclusively for Blackstone and TBG CareCo and no-one else in connection with the Offer, and will not be responsible to anyone other than Blackstone and TBG CareCo for providing the protections afforded to clients of Deutsche Bank nor for providing advice in relation to the Offer or in relation to the content of this announcement or any other transaction or arrangement referred to herein.

Rothschild, which is authorised and regulated by the Financial Services Authority in the United Kingdom, is acting for NHP and no one else in relation to the Offer and will not be responsible to anyone other than NHP for providing the protections afforded to clients of Rothschild or for providing advice in relation to the Offer or in relation to the contents of this announcement or any transaction or arrangement referred to herein.

Collins Stewart, which is authorised and regulated by the Financial Services Authority, is acting for NHP and no one else in relation to the Offer. Collins Stewart is not acting for, and will not be responsible to anyone other than NHP for providing the protections afforded to customers of Collins Stewart or for providing advice in relation to the Offer or in relation to the contents of this announcement or any transaction or arrangement referred to herein.

The release, publication or distribution of this announcement in certain jurisdictions may be restricted by law and therefore persons in any such jurisdictions into which this announcement is released, published or distributed should inform themselves about and observe such restrictions.

Copies of this announcement and any formal documentation relating to the Offer are not being, and must not be, directly or indirectly, mailed or otherwise forwarded, distributed or sent in or into or from Australia, Canada or Japan and will not be capable of acceptance by any such use, instrumentality or facility within Australia, Canada or Japan and persons seeking such documents (including custodians, nominees and trustees) must not mail or otherwise forward, distribute or send them in or into or from Australia, Canada or Japan. The Offer (unless otherwise determined by TBG CareCo and permitted by applicable law and regulation), will not be made, directly or indirectly, in or into, or by the use of mails or any means of instrumentality (including, without limitation, telephonically or electronically) of interstate or foreign commerce of, or any facility of a national, state or other securities exchange of Australia, Canada or Japan and the Offer will not be capable of acceptance by any such use, means, instrumentality or facilities.

The ability of NHP Shareholders who are not resident in the United Kingdom or the United States to accept the Offer may be affected by the laws of the relevant jurisdictions in which they are located. Persons who are not resident in the United Kingdom or the United States should inform themselves of, and observe, any applicable requirements.

This document, including information included or incorporated by reference in this document, contains “forward-looking statements” concerning TBG CareCo and NHP. Generally, the words “will”, “may”, “should”, “continue”, “believes”, “expects”, “intends”, “anticipates” or similar expressions identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond the companies’ ability to control or estimate precisely, such as future market conditions and the behaviour of other market participants. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to have been correct. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this document.

TBG CareCo or companies in association with TBG CareCo may purchase NHP Shares otherwise than under the Offer, such as in open market or privately negotiated purchases. Such purchases may be made either directly or through a broker and such purchases shall comply with the applicable laws of the UK as well as the rules of the London Stock Exchange and the City Code. TBG CareCo shall disclose in the UK and the United States by means of a press release such purchases of NHP Shares outside the Offer as required by applicable UK law, as well as the rules of the London Stock Exchange and the City Code.

The Offer in the United States is being made solely by TBG CareCo pursuant to an exemption from the US tender offer rules provided by Rule 14d-1(c) under the US Securities Exchange Act of 1934 (as amended). Neither UBS, Deutsche Bank, nor any of their respective affiliates, is making the Offer in the United States.

Conditions and certain further terms of the Offer

The Offer, which will be made outside the United States by UBS and Deutsche Bank for and on behalf of TBG CareCo and in the United States by TBG CareCo, will comply with the applicable rules and regulations of the UK Listing Authority, the London Stock Exchange and the City Code, will be governed by English law and will be subject to the jurisdiction of the courts of England. In addition it will be subject to the terms and conditions set out in the Offer Document and related Form of Acceptance.

1. Conditions of the Offer

The Offer will be subject to the following conditions:

2. Further terms of the Offer

The Offer will lapse if it is referred to the UK Competition Commission before the later of 3:00 p.m. (London time) on the first closing date of the Offer and the date on which the Offer becomes or is declared unconditional as to acceptances. If the Offer so lapses, the Offer will cease to be capable of further acceptance and persons accepting the Offer and TBG CareCo will cease to be bound by Forms of Acceptance submitted on or before the time when the Offer lapses.

The Offer will lapse if the European Commission either initiates proceedings under Article 6(1)(c) of Council Regulation (EC) 139/2004 or makes a referral to a competent authority of the United Kingdom under Article 9(3)(b) of that Regulation and there is a subsequent reference to the UK Competition Commission, in either case before 3:00 p.m. (London time) on the first closing date of the Offer or the date on which the Offer becomes or is declared unconditional as to acceptances, whichever is the later. If the Offer so lapses, the Offer will cease to be capable of further acceptance and accepting NHP Shareholders and TBG CareCo will cease to be bound by Forms of Acceptance submitted before the time when the Offer lapses.

The NHP Shares will be acquired by TBG CareCo with full title guarantee, fully paid and free from all liens, charges, equitable interests, encumbrances and any other third party rights of any nature whatsoever and together with all rights now or hereafter attaching to them, including the right to receive in full and retain all dividends and other distributions (if any) declared, made or payable hereafter.

APPENDIX II

Bases and sources

Unless otherwise stated, for the purposes of this announcement:

- Financial information relating to NHP has been extracted or provided, without material adjustment, from the Annual Report and Accounts.

- The following market prices of NHP Shares are closing, middle-market quotations derived from the Daily Official List, apart from the market price on 22 December 2000, which has been derived from Datastream:

Date Price (Pence)

Closing Price on 26 November 2004257.00

Closing Price on 14 September 2004232.00

Closing Price on 28 November 2003141.75

Closing Price on 15 September 2003137.00

Closing Price on 22 December 200018.17

Three months average price prior to and including 14 September 2004201.84

- ordinary shares of 1 pence each: 207,619,724

- options over ordinary shares of 1 pence each: 9,118,003

On the basis of:

- the current issued number of ordinary shares; the options that are exercisable below the Offer Price,

2. the fully diluted share capital of NHP comprises 216,737,727 NHP Shares.

APPENDIX III

Unaudited adjusted net assets per NHP Share

The table below sets out the calculation, for illustrative purposes only, of the unaudited adjusted net assets per NHP Share as at 30 September 2003.

The adjusted net assets per NHP Share has been calculated to assist NHP Shareholders in their financial evaluation of the Offer since they enable a comparison to be made between the terms of the Offer and the terms of previous cash offers for certain other property companies. An updated calculation based on 30 September 2004 figures will be included in the Offer Document.

Actual realisable values may differ from those stated due to a number of factors including market fluctuations. Even if realisable values were identical to those stated, the adjusted net assets are not estimates of the value of NHP on liquidation as this would have to take into account other matters such as penalties on the prepayment of indebtedness and expenses relating to the disposal of assets.

| Notes£ million Audited consolidated net assets as at 30 September 2003320.5 FRS 13 adjustment to restate financial assets and liabilities to fair value (net of taxation)(i) (22.6) Deferred taxation not provided on revaluation of investment properties and operating assets (net of unprovided deferred tax assets)(ii)(40.2) Proceeds from the exercise of outstanding ’in-the-money’ share options(iii)8.8 Adjusted net assets266.5 Fully diluted number of NHP Shares(iv)216,920,681 Adjusted net assets per NHP Shares122.8 pence |

Notes:

- The fair value adjustment to financial assets and liabilities is set out in note 21 to the audited financial statements for the year ended 30 September 2003.

Deferred taxation not provided for is set out in note 18 to the audited financial statements for the year ended 30 September 2003. The total unprovided deferred tax liability is as follows:£ million

Fair value adjustment(32.3)

Less taxation at 30 per cent.9.7

Fair value adjustment net of taxation(22.6)

£ million

Unprovided deferred tax assets in respect of accelerated capital allowances9.1

Deferred tax liability on the potential capital gain arising in relation to the revalued freeholds(49.3)

Total unprovided deferred tax(40.2)

The estimated tax payable by NHP on the event of a sale of the assets of NHP would be as set out above. The actual tax payable would depend on, inter alia, the timing and method of disposals, the actual proceeds received and the applicable tax legislation at that time. The number of outstanding share options as at 30 September 2003 is set out in note 22 to the audited financial statements for the year ended 30 September 2003. The reference price for determining whether the options are ’in-the-money’ is the Offer Price: The number of NHP Shares in issue as at 30 September 2003 is set out in note 22 to the audited financial statements for the year ended 30 September 2003.

The number of NHP Shares in issue as at 30 September 2003 is set out in note 22 to the audited financial statements for the year ended 30 September 2003.Number

NHP Shares in issue as at 30 September 2003203,375,555

Outstanding ‘in-the-money’ share options (see note (iii) above)13,545,126

Fully diluted number of NHP Shares216,920,681

APPENDIX IV

Definitions

In this announcement the following words and expressions shall have the following meanings, unless the context otherwise requires:

[To come]