Joe Zidle: The Family Feud – Sentiment vs. Fundamentals

Since US equities peaked in September, investors have priced in just about every conceivable macro risk. The result: $3.7 trillion in market capitalization erased.(1) For context, that $3.7 trillion exceeds the GDP of India, the world’s fifth largest economy.(2) That dramatic shift in sentiment led to the first 20% correction and highest intraday volatility since 2009, the highest investor outflows since 2008 and the worst December stock performance since 1931. Meanwhile, fundamentals told a much more positive story and illustrated the tension that often exists with their moodier cousin.

The market knew the risks The trade war with China, slower earnings growth, slower global GDP growth, quantitative tightening, further Fed hikes and the flattening yield curve have wreaked havoc on sentiment. Of course, the market knew every one of those risks when the S&P 500® peaked at 2,940 on September 20th. But up 10% year to date at the time, the market simply shrugged them off. Three months later, with the S&P down roughly 500 points from that peak, investors started behaving as if every one of those risks would converge in 2019 to end this near-record-long expansion.

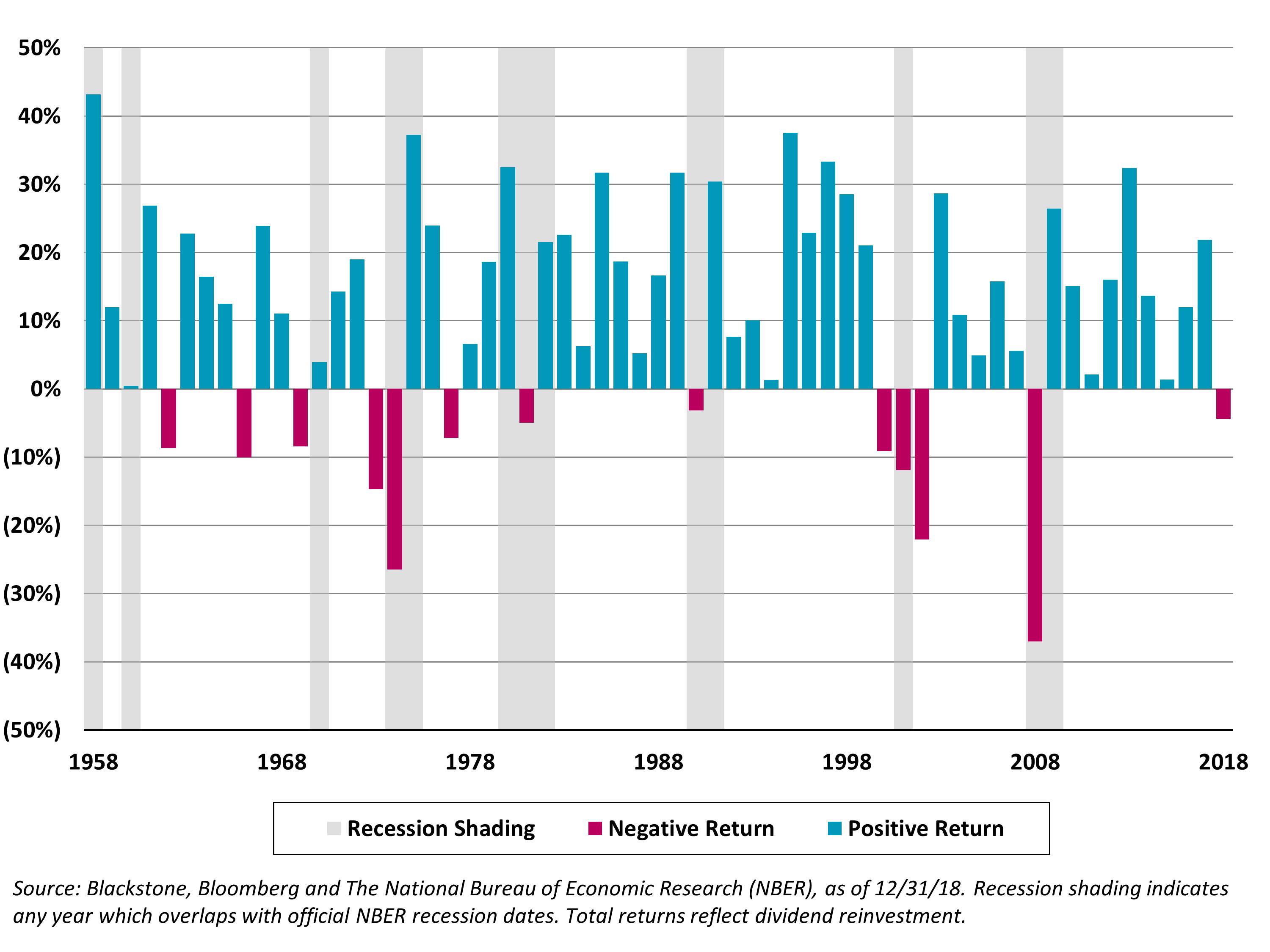

R-word concerns overblown Recession talk is on high amid the equity tumult. Here’s the thing, though: Equities are a poor predictor of economic cycles. Yield curve inversion (10-year Treasury – 2-year Treasury) is much more forward-looking, consistently preceding recessions by an average of 12-18 months. Equities don’t look that far ahead. Of the S&P 500’s 13 annual losses on a total return basis over the last 60 years, eight of them (62%) didn’t occur until right before a recession or after one had already begun (chart below), and five were false alarms. Despite 2018’s 4.4% drop, the seemingly high chance of a near-term recession that US equity markets currently price is actually on the weak side as indicators go.

Annual S&P 500 Total Return

Fundamentals still bullish Slowing growth rates and slowing growth are not the same. Investors often seem to lose sight of that fact. Earnings and economies will still expand in 2019, just not at 2018’s pace. Perhaps surprising to some, key fundamentals turned quite bullish for risk assets amid the fourth-quarter panic. In pricing slower growth, the yield on the 10-year Treasury bond fell from 3.25% to 2.65% and the Fed became more dovish, both of which are supportive of higher valuations. Elsewhere, geopolitics could provide momentum this year, with the US and China more likely to find common ground on trade.

Tension will always exist Sentiment this year will likely sit somewhere in between late September 2018’s optimism and the pessimism that followed in December. It’s also likely that, at times, sentiment will be at odds with fundamentals. Sentiment is the wild card of the two; it can swing quickly from one extreme to the other. But it is important to remember that over the long term, fundamentals define asset prices—not sentiment. Yield curves, leading economic indicators and average hourly earnings remain our preferred tools to help us understand when this cycle is at risk of rolling over. Until they tell us otherwise, we remain bullish.

1. Source: Bloomberg. Represents the period from 10/1/2018 through 12/31/2018.

2. Source: International Monetary Fund. Based on India’s nominal GDP of $2.96T, as reported by the IMF’s World Economic Outlook (October 2018.)

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.