Joe Zidle: Bullish on Oil – Overstated Supply, Understated Demand

By Joe Zidle, Investment Strategist

If you would like to receive Joe’s commentary via email, please click here to subscribe.

This past week one of the major issues weighing down oil markets was settled, at least in theory, when OPEC agreed to increase oil production. But there is ample data to suggest many OPEC members will struggle to raise their production to the higher output goals. In November 2016, when the group committed to reduce production by 1.2 Mbd, unplanned outages and other constraints resulted in real reductions closer to 1.8 Mbd. I am doubtful that the ministers are able to add even 600,000 barrels a day. Nevertheless, with a degree of uncertainty removed, the market can now focus on demand. And that data is bullish for oil.

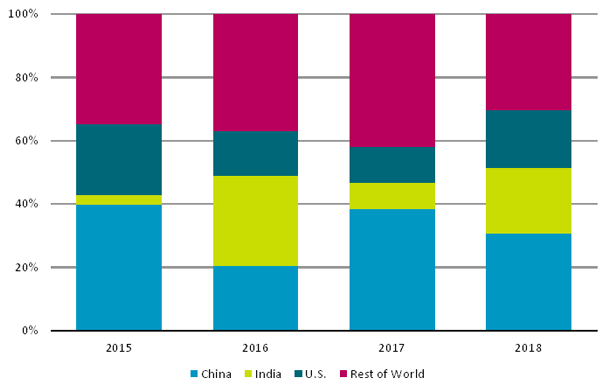

Continued demand growth Oil consumption is projected to increase by approximately 1.8 Mbd in 2018 according to the US Energy Information Agency. Three countries, China, the US and India, will be responsible for approximately 70% of that new oil demand (chart below). With oil so directly linked to economic growth, strong leading indicators are as promising for GDP growth as they are for oil prices. The US is likely entering the strongest economic growth phase seen yet in this recovery; China is deliberately slowing its economy in our view, but continues to post impressive mid-6% range growth; and India is growing fastest among major economies, upwards of 7% this year.

Approximately 70% of Oil Demand Growth from 3 Countries

Source: International Energy Agency

Pushback to our view of $80/brl, WTI One question commonly asked by clients concerns the shift away from fossil fuels in power production due to global policy pressures and climate accords. A look at the data suggests that is yet to materialize. According to the recently released annual BP Statistical Review of World Energy, the mix between oil & gas, non-fossil fuels and coal for power is unchanged over the last 20 years. In other words, the reliance on these non-renewables for power production hasn’t been reduced despite coordinated policies to encourage the development of alternatives.

Gains in energy efficiency are slowing Clients often raise points about how technological advances, better gas mileage and electric vehicles increase energy efficiency over time. To measure that, analysts use a ratio between oil consumption and GDP growth. Interestingly, the annual gains in efficiency have slowed recently, falling below their 10 year average. A decade ago when oil prices averaged $85/brl it was common to see productivity increase by nearly 2% a year. In 2017 that number was 1.5%.

Yes, a full blown trade war is a risk, but it is our view that tariffs are a means to an end not an end themselves. Overall, the clearer direction on oil supply, and continued stronger economic growth among the largest and fastest-growing economies reinforces our bullish stance on oil prices.

* * * * *

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.