Joe Zidle: The Oil Paradox – Supply, Demand and Investment

By Joe Zidle, Investment Strategist

On August 18th, 2018 the Mercedes Benz Superdome in New Orleans hosted a major offshore oil and gas lease sale. Up for auction were over 14,000 tracts representing more than 800,000 acres recently made available by the Trump administration. The atmosphere was not quite as adrenaline-charged as Super Bowl XLVII, where the Ravens faced the 49ers in a thrilling 34-31 contest. Nonetheless, hopes for a successful auction were still high. The result of the sealed-bid process was disappointing, however: despite oil prices being up 40% year-over-year, less than 1% of available lots had received a bid. In fact, 2013’s Super Bowl generated more money for New Orleans than the entirety of last month’s oil auction.1

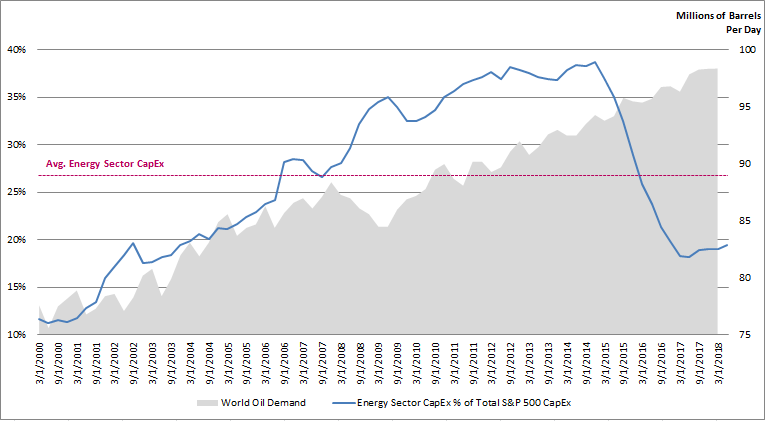

The Energy Sector’s CapEx Paradox While the lackluster sale of offshore drilling tracts represents a small piece of total US and global energy production, the weak auction is representative of a broader phenomenon: growing oil demand and tighter supplies are pushing prices higher, while investment for future development lags. Energy sector capital expenditures have been flat or declining since 2010, in contrast with increased business investment by the rest of the S&P 500′ (see chart below). This past quarter alone, S&P 500′ companies increased business spending by nearly 20% YoY. In addition, a significant number of Blackstone’s portfolio company CEOs have expressed intent to raise CapEx budgets. Meanwhile, the energy sector’s CapEx remains stubbornly below historical averages.

Chart: Mounting Demand, But Decreasing Investment 2

Source: Blackstone and Bloomberg, as of 6/30/18.

Despite This, Analysts Bearish On Oil Prices A recent Wall Street Journal survey showed analysts at investment banks predict WTI and Brent prices will be lower in 2019. Forecasters at the Energy Information Agency (EIA) also predict somewhat lower prices next year. As we have written previously, oil demand is set to rise by 1.6mbd in 2018 but supply will trail by almost 500,000mbd.3 For this reason, it strikes us as unlikely that the combination of accelerating demand, wilting supply and a lack of investment for future development will produce lower oil prices in 2019. (For more, please see our June 27th piece, “Overstated Supply, Understated Demand.”)

Bullish Oil, Bullish Energy Business Spending After the commodity supercycle ended in 2014, investors turned their backs on the sector: flows into energy-related mutual funds and ETFs dried up, and the sector fell from a peak of 16% of the S&P 500′ market share to 6% as of 6/30/2018.4 In the meantime, energy companies have found it hard to access both debt and equity capital markets. While private equity has moved in to fill some of this gap, funding for expansion remains scarce. We believe oil prices will remain at current levels or head higher, and in our view investors who step up to provide capital to energy companies will be rewarded.

1. PwC US estimated that Super Bowl XLVII would generate $185M in visitor spending vs auction proceeds of $180M.

2. Source: Blackstone and Bloomberg, as of 6/30/18.

3. Source: www.eia.gov, as of 9/02/18.

4.Source: Blackstone and Morningstar Direct, as of 6/30/18.

The views expressed in this commentary are the personal views of the author and do not necessarily reflect the views of The Blackstone Group L.P. (together with its affiliates, “Blackstone”). The views expressed reflect the current views of the author as of the date hereof and Blackstone undertakes no responsibility to advise you of any changes in the views expressed herein.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform services for those companies. Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. All information in this commentary is believed to be reliable as of the date on which this commentary was issued, and has been obtained from public sources believed to be reliable. No representation or warranty, either express or implied, is provided in relation to the accuracy or completeness of the information contained herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This commentary discusses broad market, industry or sector trends, or other general economic, market or political conditions and has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any investment recommendation. Past performance is not necessarily indicative of future performance.