Blackstone Life Sciences (BXLS)

We combine scale capital with deep clinical development expertise to help advance innovative medicines and technologies with the potential to transform patients’ lives. Our team invests across the life cycle of companies and products in a range of therapeutic areas.

147

Medicines Brought to Market*

21

MDs or PhDs on the Team

84%

Phase 3 Success Rate**

WHAT WE DO

We partner with pharmaceutical, biotech and medical technology companies to fund products that address unmet medical needs and have the potential to improve the quality of life for patients around the world.

Filling a Void

Blackstone Life Sciences (BXLS) fills a critical void in the industry. While the life sciences are seeing unprecedented innovation driven by rapid advancements in science and technology, there is a lack of funding necessary to bring medicines and healthcare technologies to market. We invest in and partner with pharmaceutical, biotechnology and medical technology companies to help meet this need.

Expertise and Scale

BXLS combines clinical, commercial and operational expertise with Blackstone’s knowledge and global network, access to capital, resources and infrastructure. We commit our skill and scale to select, fund and advance what we believe to be the most promising life science products and companies through hands-on involvement and directly applied expertise.

Managing Risk

We seek to deliver value for investors by focusing on areas where we can apply our deep clinical and commercial domain expertise. By investing in promising candidates in late-stage development, we aim to make a positive impact on the most people with the lowest clinical risk.

Case Studies

The Blackstone Life Sciences team of employees, Senior Advisors and Development Company personnel is responsible — both in its current capacity and prior experiences— for bringing 147 medicines to market in 12 different therapeutic areas.*

Moderna Collaboration

In March 2024, Blackstone Life Sciences announced a new collaboration to advance Moderna’s influenza mRNA vaccine program, for which BXLS will provide up to $750M of funding. This landmark transaction showcases our long-standing strategy to collaborate with the world’s leading life science companies to advance their critical path products.

Alnylam

In April 2020, BXLS led a $2 billion strategic collaboration with Alnylam anchored around the acquisition of a royalty interest in inclisiran, an innovative product, which will potentially bring new benefits to patients with high cholesterol — a major risk factor for cardiovascular disease. The drug began receiving regulatory approvals globally in the fall of 2021.

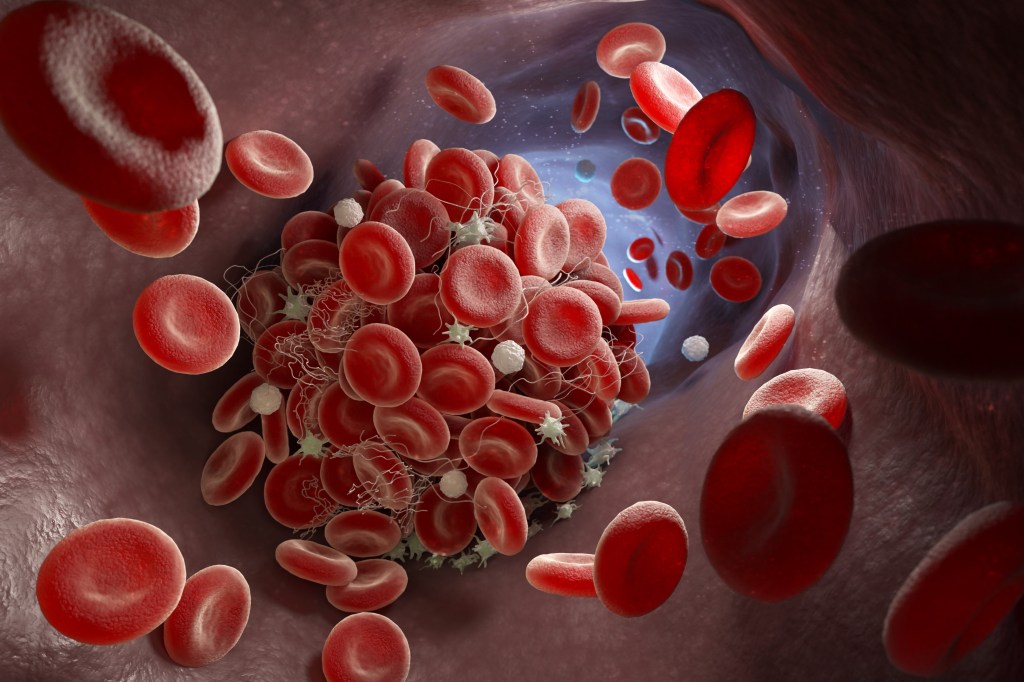

Anthos Therapeutics, Inc.

In February 2019, BXLS invested in Anthos Therapeutics, Inc., in partnership with Novartis, to advance next-generation targeted therapies for high-risk cardiovascular patients. This investment will potentially help meet a large, unmet need for next-generation antithrombotic therapies for patients that are underserved by more conventional medicines. According to the American Heart Association, thrombotic disorders cause nearly 500,000 deaths each year.

Note: All figures as of March 31, 2024, unless otherwise indicated.

*Medicines brought to market by BXLS and development company employees and advisors (Nick Galakatos, Paris Panayiotopoulos, Emmett Cunningham, Kurt Wheeler, Barry Gertz, Dennis Henner, Ed Scolnick, Kiran Reddy, Francois Nader, Olivier Brandicourt, John Maraganore, Jay Bradner) while they worked at BXLS, Clarus and at prior employers. The development of a medicine involves many professionals. The degree of involvement by a given BXLS professional varies medicine to medicine. Therefore, the performance shown reflects the contributions of a number of professionals and may not be indicative of any individual’s contributions to the transactions. The number of developed medicines is measured when a drug is approved in any jurisdiction. Senior Advisors are not employees of Blackstone.

**As of March 31, 2024. Based on Phase III drug developments analyzed between 2010–2024. In deriving the Phase III success rate, Blackstone uses the same methodology as Evaluate Pharma, neither of which methodology incorporates data relating to approval for MedTech products. In determining the success rate, both Blackstone and Evaluate Pharma consider a drug’s approval by the US FDA or the EMA to each count as a separate, independent approval and a drug’s approval in each new indication to also be considered an approval when calculating the success rate. This methodology will result in a higher success rate than would otherwise result if only one of the aforementioned types of approval were used when calculating the success rate. For purposes of calculating the success rate, Blackstone does not include any Phase III trials that were never initiated. A trial is considered “initiated” when the first patient is enrolled in a clinical trial. For the avoidance of doubt, Blackstone considers suspended, abandoned, or never completed trials as “failures” when determining the success rate. Whereas Evaluate Pharma’s review period is as of January 1, 2000- May 31, 2018, BXLS’ review period is from 2010 to 2024, which coincides with the period beginning when BXLS, through a predecessor fund, made its first investment in a Phase III drug trial. Evaluate Pharma’s data represents their most recently available data. There are risks and limitations to comparing BXLS’ shortened period of review to Evaluate Pharma’s longer and different period because market conditions, including among others macroeconomic factors and regulatory and policy considerations, as well as other factors beyond BXLS’ control, change regularly and could adversely impact the likelihood of approval, thereby negatively impacting the industry’s and BXLS’ success rates in a given time period. These and numerous other factors may adversely affect the success rates, and thus success rates in one time period are not directly comparable to success rates of drugs evaluated in different time periods.

Updates from Life Sciences

PE Hub

Blackstone Life Sciences’ Nicholas Galakatos Hails ‘New Era in Medicine’

Nick Galakatos, Global Head of Blackstone Life Sciences, discusses the recent wave of potential medicines thanks to innovation and breakthroughs in technology – and how partners like BXLS can help accelerate treatment development pipelines that would otherwise be limited by the availability of capital.

BioSpace

Sanofi Rebounds with $329M Blackstone Infusion for Multiple Myeloma Drug

BioSpace covers Blackstone’s partnership with Sanofi, which aims to accelerate the pharma company’s ability to provide the subcutaneous formulation of multiple myeloma drug Sarclisa to patients in a more innovative and convenient manner. This investment exemplifies BXLS’ commitment to providing flexible capital to help advance vital medicines.

WSJ

New Blood Thinners Will Prevent Blood Clots Without Causing Bleeding

Several blood thinners are being developed that could prevent the clots that cause heart attacks and strokes – without some of the side effects.

“We support promising companies and products, providing flexible capital and clinical expertise to advance innovation and improve outcomes for patients.”

NICK GALAKATOS, PHDGLOBAL HEAD OF LIFE SCIENCES